By 2025, financial analysts are expected to not only excel in quantitative analysis but also bring strong technological and data interpretation skills to the table. Understanding “financial analyst interview questions” is crucial for candidates aspiring to thrive in this dynamic field. This guide will prepare you for what to expect and how to impress in your financial analyst interviews

What are Financial Analyst Interview Questions?

Financial analyst interview questions assess a candidate’s ability to gather, analyze, and interpret financial data to help companies make business decisions. These questions typically cover topics such as financial reporting, forecasting, data analysis, and the use of financial software, aiming to evaluate the candidate’s analytical skills, accuracy, and strategic thinking.

Most Common Financial Analyst Interview Questions

How do you assess a company’s financial health?

This question examines your understanding of financial metrics and analysis methods. It’s important to discuss the indicators you use to evaluate financial stability and growth potential.

Example: “I assess a company’s financial health by analyzing key financial statements, liquidity ratios, debt ratios, and profitability metrics, such as ROI and EBITDA, to gain a comprehensive view of its financial standing.”

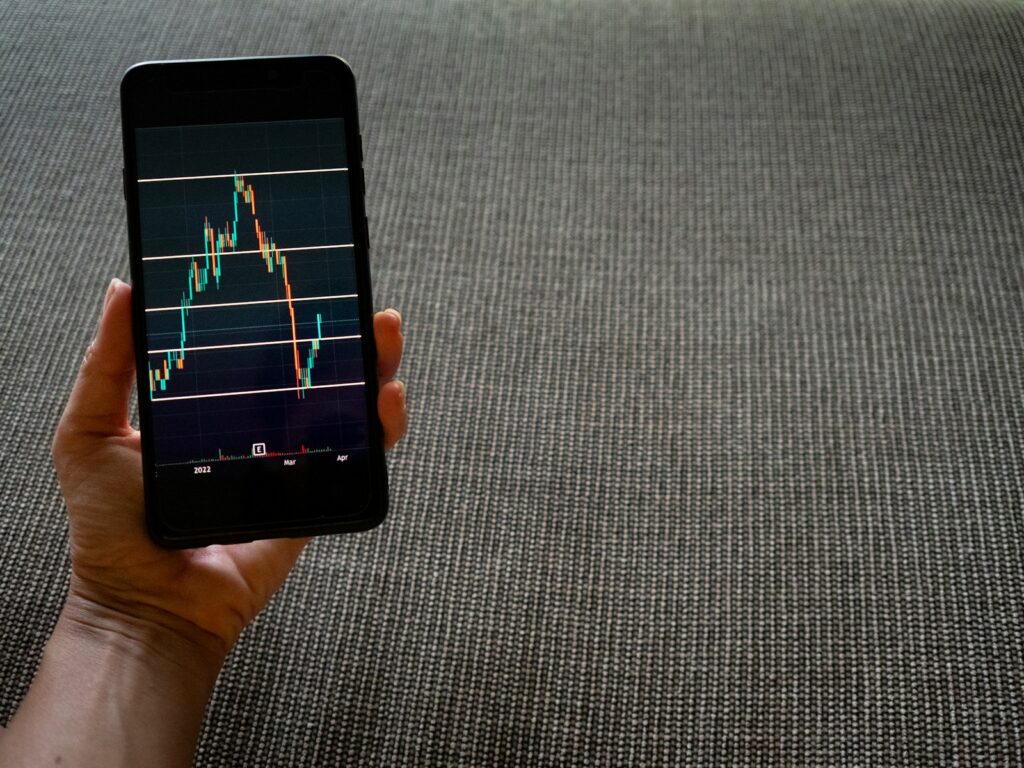

Describe your process for financial forecasting?

Forecasting is a fundamental skill for financial analysts, and this question tests your ability to predict future financial conditions based on historical data.

Example: “My financial forecasting process involves collecting historical data, analyzing trends, considering economic and industry factors, and using statistical tools to project future performance.”

What experience do you have with financial modeling?

Financial modeling is crucial for complex analyses and decision-making. This question allows you to showcase your technical skills.

Example: “I have extensive experience creating and managing financial models in Excel and proprietary software, used for everything from budgeting and forecasting to capital investment analysis.”

How do you ensure accuracy in your financial reports?

Accuracy is critical in financial reporting. This question explores your attention to detail and your process for quality assurance.

Example: “To ensure accuracy in financial reports, I meticulously validate all data inputs, use automated tools to reduce human error, and conduct thorough reviews with cross-functional teams before finalizing reports.”

Can you explain a time when you identified a significant financial risk during your analysis?

Identifying risks is key to preventing losses. This question assesses your proactive risk management skills.

Example: “In a previous role, I identified a significant financial risk related to currency fluctuations affecting procurement costs. I recommended early procurement and hedging strategies, which saved the company over $500,000.”

What software tools are you proficient in for financial analysis?

Proficiency in financial software is essential for modern financial analysts. This question tests your technical toolkit.

Example: “I am proficient in SAP, Oracle, and Advanced Excel, including VBA for automating repetitive tasks and enhancing report generation processes.”

How do you handle tight deadlines, especially during financial closing periods?

Time management and stress resistance are crucial traits for a financial analyst. This question evaluates how you manage workload and pressure.

Example: “During tight deadlines, I prioritize tasks based on urgency and complexity, delegate where appropriate, and maintain clear communication with my team and stakeholders to ensure timely and accurate report submissions.”

Discuss a financial analysis report that you are particularly proud of?

This question gives you the opportunity to discuss your direct impact on business decisions or outcomes through your analytical work.

Example: “I developed a comprehensive profitability analysis report that segmented revenue streams and identified underperforming products, leading to a strategic realignment that increased our gross margin by 15%.”

How do you stay updated with economic trends that impact your industry?

Staying informed is essential for anticipatory and strategic financial analysis. This question probes your methods for keeping your knowledge current.

Example: “I keep abreast of economic trends by subscribing to industry newsletters, attending webinars, and participating in professional groups that focus on economic impacts in our sector.”

What strategies do you use to communicate complex financial information to non-financial stakeholders?

Effective communication is key to ensuring that financial insights are understood and actionable. This question tests your ability to simplify complex data.

Example: “I use clear visuals, such as charts and graphs, and I explain financial concepts in layman’s terms during presentations to ensure stakeholders understand the implications of the data.”

How to Get Prepared for Financial Analyst Interview Questions

Enhance Your Financial Knowledge

Stay up-to-date with financial regulations, trends, and tools. Regularly engage with financial publications and consider additional certifications like CFA or CPA.

Develop Technical Proficiency

Practice financial modeling and analysis using various software tools to ensure you are proficient and can discuss your expertise confidently.

Prepare Detailed Examples

Have specific examples ready that highlight your analytical skills, attention to detail, and impact on past employers, focusing on scenarios that relate to the job you’re applying for.

Simulate Interview Scenarios

Conduct mock interviews with mentors or peers to refine your ability to articulate your skills and experiences effectively under pressure.

Special Focus Section: Integrating AI in Financial Analysis

Discuss the increasing role of artificial intelligence in financial analysis, from automated reporting systems to predictive analytics.

- Key Insight: Explore how AI can enhance accuracy and speed in financial forecasting.

- Expert Tip: Consider discussing ethical considerations and the need for transparency when using AI-driven analysis tools.

Conclusion

Mastering financial analyst interview questions in 2024 involves more than just crunching numbers—it requires a blend of technical skills, industry knowledge, and strategic thinking. Equip yourself with these insights and practical tips to demonstrate your value and vision in your next interview, ensuring you stand out as a well-rounded candidate ready to tackle the challenges of the modern financial landscape.